tax per mile san diego

SANDAG is still looking into how it. NBC 7s Melissa Adan has more information for you.

Electric Cars From Tesla And Gm May Start Losing Their Tax Credits Tax Credits Tesla Tax

In addition to the regional wide sales tax which if added together will mean four cents per mile through 2050.

. San Diego California 92101. A four-cents-per-mile road usage tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 were some of the. The board is expected to vote on the proposal Dec.

What the county believes is just a 2-cent addition piles up to create around 075 per mile including an existing state-level gas tax of. Governmental leaders across California as well as in other states such as Utah and Oregon have been. Unelected Executive Director Hasan Ikhrata is pushing a 163 billion transportation plan that includes TAXING San Diegans per mile driven increasing the sales tax and more.

Revenue from the proposed four-cent-per-mile tax would go toward the projects as would two half-cent regional sales taxes scheduled for 2022 and 2028. Under the plan starting in 2030 it will cost 33 cents per mile. 401 B Street Suite 800.

SANDAG voted Friday to begin the public comment period for a road usage charge of four cents per mile. Under the 163 billion proposal a four-cent-per-mile tax and two half-cent regional sales taxes were proposed for 2022 and 2028. San Diego proposes a milage tax to fund a 160 billion regional plan to increase public transit usage from 34 percent to 13 percent over the next 30 years.

San Diego floats 4 cent per mile tax on all drivers. The four-cent-per-mile tax -- and two half-cent regional sales taxes scheduled for 2022 and 2028 -- is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious 30-year 160. Among other things SANDAG hopes to make public transit free for everyone.

SANDAG is considering a new mandate to tax drivers per miles driven causing mixed reaction. The proposed tax is part of a 163 billion plan to improve transportation in San Diego County. Drivers in San Diego may be.

27 Oct 2021 1150 am. Under the 163 billion proposal drivers would be charged a few cents for every mile they drive locally as a way to fund road and transit improvements. The San Diego Association of Governments board will meet virtually Friday to discuss a four cent-per-mile tax proposal which could impact every driver in San Diego County by 2030.

A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday. Posted on October 28 2021 809 am. The San Diego agency expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a total of 4 cents per mile driven.

SANDAG expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a total of 4. There is no specific mileage charge of 4 to 6 cents or of any size presently up for approval although San Diegos proposed Regional Transit Plan. The policy would introduce a 2- to 6-cent tax on drivers per mile on local roads to help pay for the improvements.

A four-cents-per-mile road usage tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 were some of the key funding strategies SANDAG leadership proposed to support he plan. It claims this will. 29 a four-cent-per-mile tax proposal that could impact every driver in San Diego County by 2030.

NBC Universal Inc. By Evan Symon October 27 2021 1150 am. San Diego Association of Governments.

The four-cent-per-mile tax is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious 30-year 160 billion proposal which could include no. The San Diego Association of Governments SANDAG board of directors approved Oct. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that.

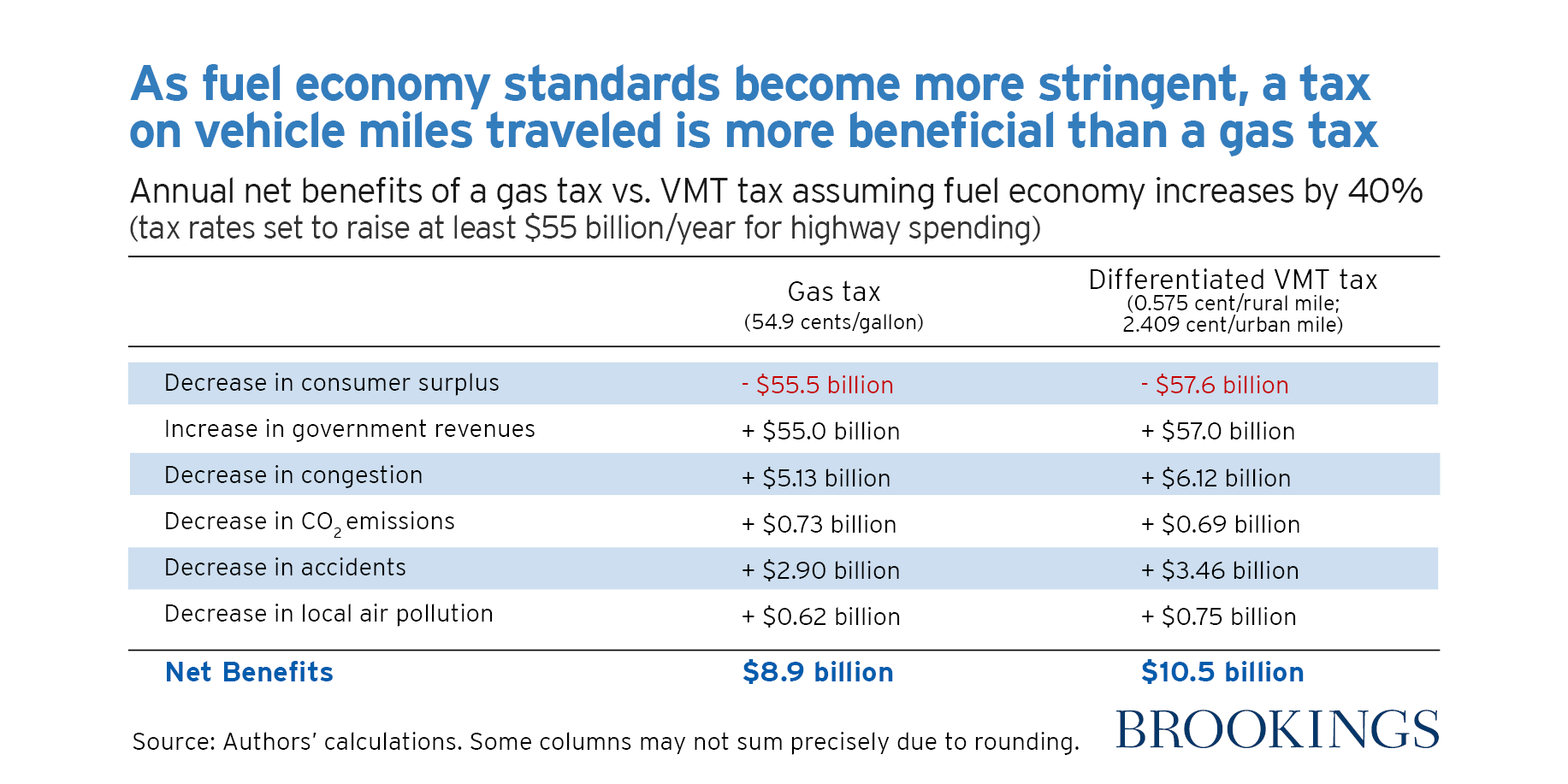

The proposed mileage tax is intended to supplement and eventually replace gas taxes which have dropped considerably as gas mileage has increased and hybrid and electric cars. The four-cents-per-mile tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious.

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Home Share Taxes Driving You Crazy Don T Worry Our Super Simple Airbnb Tax Guide Will Answer All Of Your Questions In Tax Guide Online Taxes Sharing Economy

Electric City Cars City Car Best Electric Car Top Electric Cars

Top Digital Commerce Company San Diego Ca Small Business Bookkeeping Accounting Accounting Software

Gray Whale Migration Map Whale Watching In San Diego Is Happening Now Whale Migration Gray Whale Whale

Pin By O Gara Coach La Jolla On Lease Specials Cars For Sale Car Find Lease

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Summer Road Trip Real Life Math Project Based Learning Pbl Real Life Math Math Projects Middle School Project Based Learning Math

I Drove 200 Highway Miles Staying In The Inside Lane To See If It Would Shorten My Trip Driving How To Find Out Trip

Pin On Criminal Defense Attorney

How To Calculate Per Mile Earnings Instead Of Per Hour

1200 Week Rental Rates For Premium Passenger Sprinter Vans Rates Include Applicable Taxes And Fees Daily 190 00 225 00 Sprinter Van Mercedes Van Van

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

April 6 Is Drowsy Driving Day Drowsy Driving Drowsy Mario Characters